Leaving Chardan.com

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close

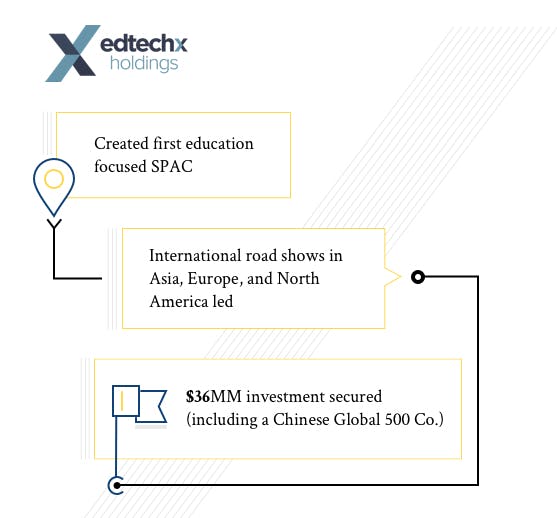

Leading the coordination of 6 broker/dealers, Chardan spearheaded the creation of the first SPAC focused on education services. We drove all investor communications and conducted road shows across Asia, Europe and North America. Ultimately $36MM in capital was secured from institutional investors including a Chinese Global 500 company.

Chardan serves as both advisor and partner in helping to both successfully raise capital through an IPO and then in identifying target acquisition candidates.

Finance your growth strategy by taking your company public through a flexibly structured merger with a Special Purpose Acquisition Company (SPAC).

Combine participation in high-growth, disruptive businesses with the confidence and security of cash held in trust and equity upside.

We've received your information, and we're processing your request.

One Pennsylvania Plaza

Suite 4800

New York, NY 10119

One East Putnam Ave, 4th Fl. Greenwich, CT 06830

Log in to read reports online.

Log infor help or if you would like to get provisioned for access.

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close