Leaving Chardan.com

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close

Taysha Gene Therapies, a Dallas-based biotechnology company developing novel gene therapies targeting severe and life-threatening monogenic diseases of the central nervous system (CNS), was formed on foundational science from Steven Gray, PhD and Berge Minassian, MD of the UT-Southwestern Gene Therapy Program.

Seed and Series B

Chardan’s relationships with key stakeholders and scientific expertise within in its healthcare banking platform made it uniquely positioned to advise Taysha on the roll-up of AAV gene therapy programs. Chardan advised the company on portfolio strategy and early-stage investor marketing to create an accelerated financing outreach that resonated with key investors.

After the company identified their lead seed investor, Chardan swiftly organized a roadshow to introduce the Company to new investors and shape the financing syndicate.

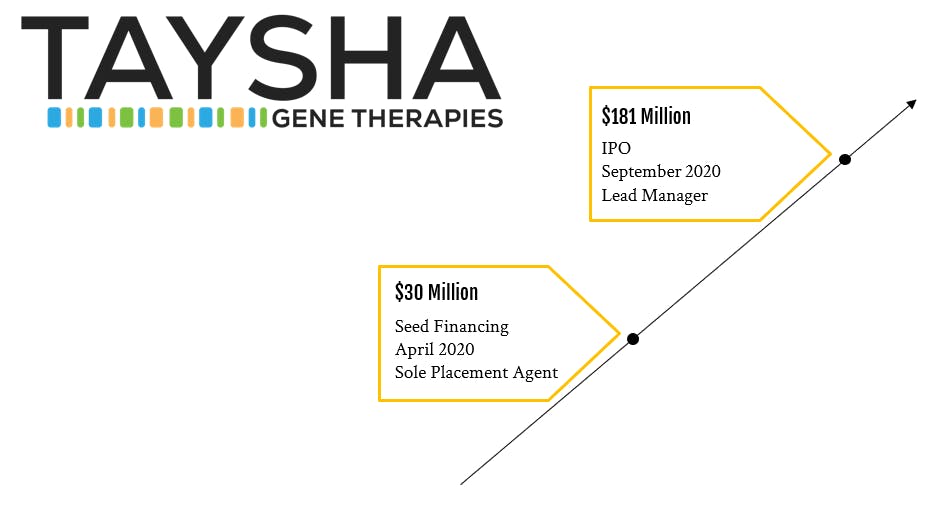

In addition to a successful $30 million seed round, Chardan’s marketing efforts created a foundation and level of familiarity among blue chip institutional healthcare investors. These relationships proved to be instrumental to the Company’s outreach and investor participation for its $95 million Series B prior to IPO.

IPO

Taysha priced an upsized $181 million IPO in September 2020 with Chardan acting as lead manager. Chardan’s transactional expertise from early-stage private financings through public market offerings matched the Company’s needs to accelerate to an IPO within a year of its founding.

The opportunity arose for Chardan to execute this transaction due to its extensive work in the gene therapy sector and differentiated understanding of leading academic research.

We've received your information, and we're processing your request.

One Pennsylvania Plaza

Suite 4800

New York, NY 10119

One East Putnam Ave, 4th Fl. Greenwich, CT 06830

Log in to read reports online.

Log infor help or if you would like to get provisioned for access.

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close