Leaving Chardan.com

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close

Background

Founded in 2017, Diginex is a rapidly growing digital financial services and blockchain solutions company headquartered in Hong Kong with a global presence.

Advising

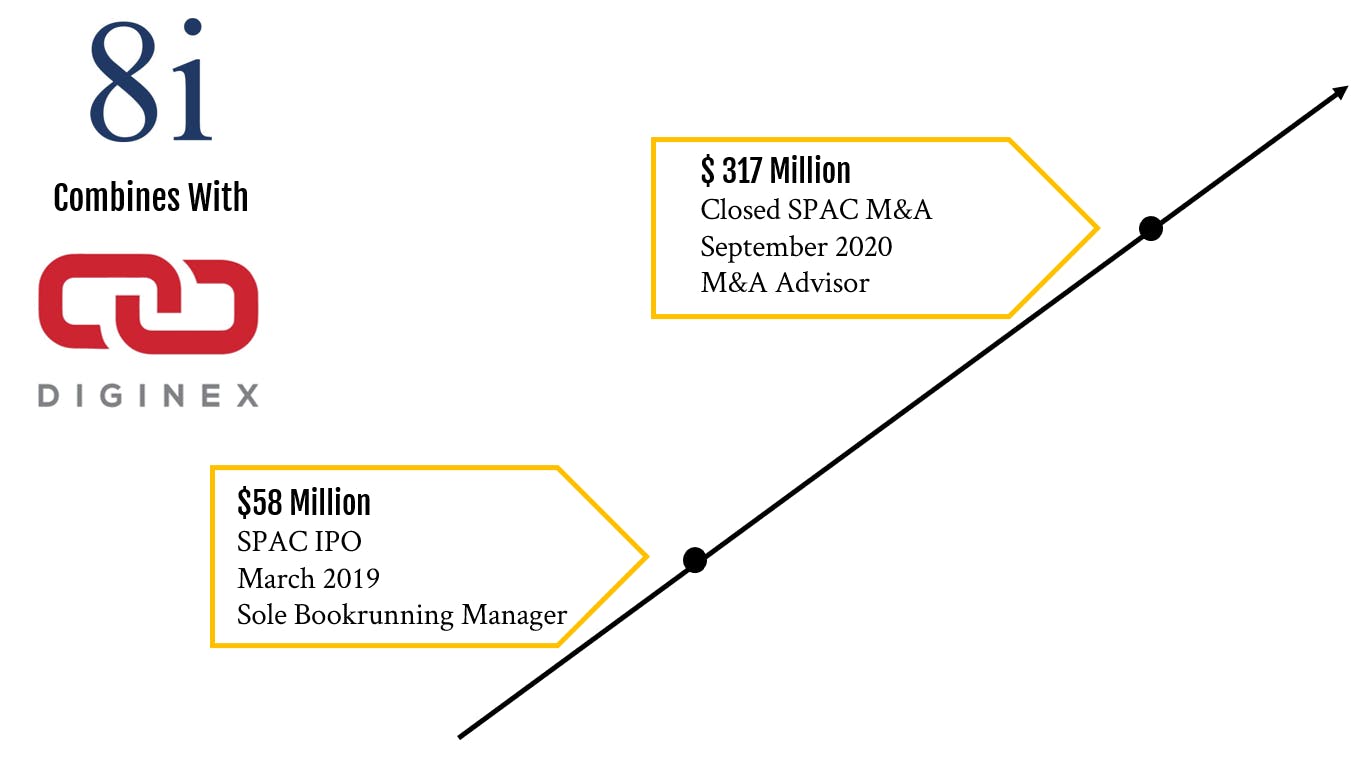

Chardan, as M&A advisor, advised on Diginex’s listing, structure and regulatory elements. Diginex’s EQUOS is the first crypto exchange with a parent listed on a US stock exchange. Diginex raised more than $20 million in a convertible note, upsized from an initial target of $15 million. Diginex and current management exchanged 100% of their holdings for shares of 8i Enterprises (Nasdaq: JFK).

SPAC M&A

Chardan crafted and supported key communication between investors and 8i Enterprises and Diginex throughout the SPAC M&A process. 8i Enterprises listed its IPO in March 2019. The merger was announced in July 2019 and closed in September 2020 with a transaction value of $317M. Pro-forma ownership: Diginex: 79%, JFK Public Shareholder: 9%, JFK Sponsors: 6%, Others: 6%.

* On October 13, 2021, the name of the Company was officially changed to EQONEX Limited, following shareholder approval at the Company’s Annual General Meeting held on September 29, 2021.

We've received your information, and we're processing your request.

One Pennsylvania Plaza

Suite 4800

New York, NY 10119

One East Putnam Ave, 4th Fl. Greenwich, CT 06830

Log in to read reports online.

Log infor help or if you would like to get provisioned for access.

You're leaving Chardan.com and going to an external site. Are you sure you want to leave Chardan.com?

CONTINUE Cancel and close